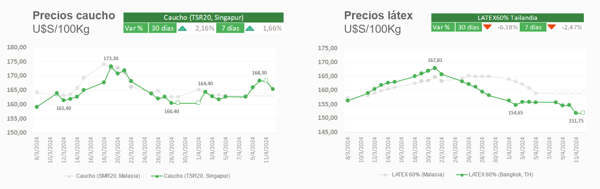

This week, rubber and latex prices, which were previously quite close, have slowly begun to separate, seeking to reach an average equilibrium. A drop in latex prices was observed, unlike those of natural rubber (TSR20). An important news of the week was the inflation data in the United States, which turned out to be higher than expected. What impact could this have on the global economic recovery?

Impact of inflation in the US on prices of commodities such as natural rubber

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(13).png)

Inflation in the US surprised by accelerating to 0.4% monthly in March (3.5% annually). Given this data, which is far from the 2% annual objective, it is likely that the United States Federal Reserve will maintain an aggressive anti-inflationary policy, avoiding a rate cut. The potential consequences could be a weaker economic recovery and an appreciating dollar. Both things can impact a lower price of commodities, such as natural rubber.

Upward revision of natural rubber production estimate for 2024

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(15).png)

The specialized consulting firm WhatsNextRubber revised upwards its natural rubber production estimate for 2024. It now expects a rebound of 4.1% to 14.47 million tons. Growth in production would begin to be felt towards May and June. Thereafter, we could see downward pressure on prices, if this effect is not offset by an improvement in demand from China.

.png?width=180&height=180&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(11).png) China's growth projections improve, but fiscal risks remain

China's growth projections improve, but fiscal risks remain

Two major global consultancies upgraded China's growth projections based on better-than-expected industry and export performance. Goldman Sachs increases it from 4.8% to 5.0% and Morgan Stanley from 4.2% to 4.8%. However, the main risks remain. One of them is the high fiscal deficit of subnational governments. On this point, the risk rating agency Fitch worsened the projection of Chinese sovereign debt, changing it from stable to negative.

Stable Trends and Potential Risks in Ocean Freight Rates:

-

- In a recently published note, The Economist reports that ocean freight rates are expected to remain relatively stable in the near future. However, it warns of an upward risk if exports from Asia increase. Both scenarios assume that there is no major progress in the situation in the Suez Canal.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment