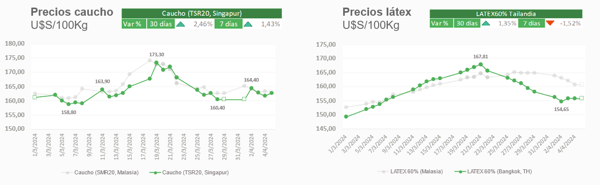

Prices reached a peak in mid-March, but then had a sharp decline that offset most of the initial rise. Will they continue to decline? In principle we believe not, given that the latest demand data has been much better than expected.

Optimistic outlook:

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(17).png)

Prices fall due to profit taking, in the midst of days with low levels of operations. However, there are good prospects in the short term due to demand that remains firm and supply still affected by climatic complications in Thailand. At least until the second half, when the weather could become more benign for production, we expect high prices. Some analysts point out that most of the correction has already been made.

Confidence in the Chinese market and favorable projections for the rubber sector:

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(11).png)

The market becomes more optimistic regarding the evolution of the Chinese economy. In March, the industry had higher-than-expected growth in both the official and private indexes prepared by the Caixin group. Good performance of services is also observed. Regarding segments more associated with the rubber business, we are observing a very good start to the year for tire sales, which are at record levels in the case of light vehicles. The good momentum of this segment is expected to continue for the rest of the year. Sales of truck tires, on the other hand, remain at low levels despite a very recent recovery.

.png?width=180&height=180&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(12).png) Global growth expectations improve according to S&P:

Global growth expectations improve according to S&P:

The consulting firm S&P revised its global growth prospects upward, going from 2.3% to 2.5%, mainly due to an improvement in the expected performance for the United States. On the other hand, the president of the US Federal Reserve says that more evidence that inflation is heading at a rate of 2% annually is needed to reduce interest rates.

Maritime Transport Updates: Rates, Capacity and Fuels

- Some shipping companies announce rate increases for April. The increase of Hapag Lloyd for the Asia-South America route stands out.

It increases the carrying capacity, but is absorbed by the impact of the Red Sea conflict. There is a risk that a future overcapacity scenario is brewing if the conflict is resolved.

Possible fuel increase due to increase in oil prices.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment