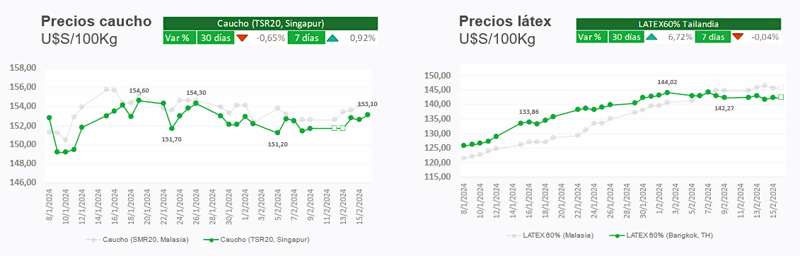

Currently, the natural rubber and latex market shows a trend of stability in prices. Although the latest published estimates indicate a slight improvement in production from Southeast Asia, declining consumption in China is putting a brake on the price escalation seen in previous months. This is reflected in the price between TSR20 rubber and latex, which remains at relatively low levels.

The Impact of Declining Chinese Consumption

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(11).png) Consumption in China continues to fall, influenced by deflation, which discourages purchases. Consumer confidence is negatively affected, impacting not only consumption but also investments, with a notable shift towards assets considered safe such as gold. This change in behavior is slowing the recovery in natural rubber prices, crucial for sectors such as construction, which have traditionally benefited from real estate investment.

Consumption in China continues to fall, influenced by deflation, which discourages purchases. Consumer confidence is negatively affected, impacting not only consumption but also investments, with a notable shift towards assets considered safe such as gold. This change in behavior is slowing the recovery in natural rubber prices, crucial for sectors such as construction, which have traditionally benefited from real estate investment.

Projections for 2024: An Analysis by WhatsNextRubber

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(12).png) Specialized consultancy WhatsNextRubber published its estimates for the natural rubber market in 2024, a modest growth of 4.1% is anticipated in natural rubber production, barely enough to reach 2022 levels. Côte d'Ivoire continues to lead the momentum in supply, while Thailand and Indonesia show minimal recoveries after experiencing notable declines the previous year.

Specialized consultancy WhatsNextRubber published its estimates for the natural rubber market in 2024, a modest growth of 4.1% is anticipated in natural rubber production, barely enough to reach 2022 levels. Côte d'Ivoire continues to lead the momentum in supply, while Thailand and Indonesia show minimal recoveries after experiencing notable declines the previous year.

Inflation in the United States: An Additional Obstacle.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(13).png)

Inflation in the United States persists, with an increase of 3.1% year-on-year in January, suggesting that a reduction in interest rates may not be imminent. This factor contributes to a more complex outlook for the natural rubber and latex market in the short term.

Impact and Strategies of Shipping Companies Faced with the Stagnation of the Conflict

- The conflict in the Red Sea remains stagnant. Shipping companies COSCO and MSC divert route capacity

transatlantic to supply Mediterranean routes. - Sea Intelligence estimates that the impact of the crisis is equivalent to an increase in capacity demand of 16% (measured in TEUsxDistance). Although it is a significant change, the increase in capacity expected during 2024 will reduce the magnitude of the problem.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment