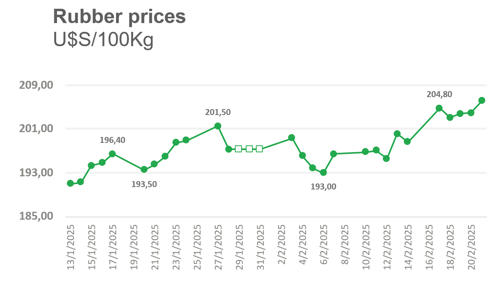

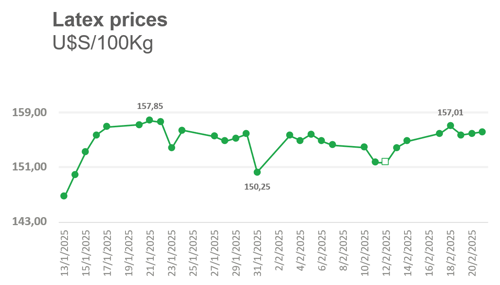

Natural rubber and latex prices remain at high levels, with weekly variations of 3.8% and 1.0%, respectively.

A meeting between the Chinese president and business leaders sparked rumors of more favorable economic policies for the private sector.

Asian markets reacted positively to the news, and in the case of natural rubber, there was a surge in speculative buying by commodity funds, pushing prices higher.

If substantial measures are confirmed to boost Chinese demand, we could see further price increases in the coming weeks.

However, structurally, we still expect a slight decline in prices in the medium term due to recovering production in Thailand and the negative impact of the ongoing trade war on rubber demand.

Commodity funds drive up natural rubber prices.

Rubber futures have surged due to strong speculative activity. It is estimated that commodity funds purchased around 700,000 tons of rubber futures on Chinese exchanges.

However, it’s important to note that such movements add volatility to the market, as prices may quickly correct downward if the expectations behind this week's purchases are not met.

These bullish expectations are driven by the prospect of more favorable policies for the private sector in China.

Markets react to Xi Jinping’s unusual meeting with business leaders.

Chinese President Xi Jinping recently met with top business leaders in an effort to restore confidence in the private sector amid a slowing economy and rising trade tensions with the United States.

Chinese President Xi Jinping recently met with top business leaders in an effort to restore confidence in the private sector amid a slowing economy and rising trade tensions with the United States.

During the meeting, Xi highlighted the "huge potential" of the private sector and promised measures to improve the business environment, including the removal of unreasonable fees or fines and the creation of a more level playing field for private companies.

Analysts interpreted this move as a signal that Beijing aims to end years of strict regulations, particularly on the tech sector, and reaffirm its support for private businesses.

Trump threatens tariffs on automobiles.

The U.S. president is seeking to impose a 25% tariff on car imports to reduce the trade deficit.

The U.S. president is seeking to impose a 25% tariff on car imports to reduce the trade deficit.

Producers in Europe and Mexico would be negatively affected, but the measure would also lead to higher car prices in the U.S., reducing demand for automobiles and, indirectly, for natural rubber used in tires.

The International Monetary Fund (IMF) has downgraded its global trade growth forecasts for 2025 and 2026 due to slower economic growth and the impact of the ongoing trade war, which is expected to reduce imports, particularly in advanced economies.The IMF now projects global trade to grow by 3.2% in 2025 (down from the 3.4% estimated in October 2024) and by 3.3% in 2026 (also down from a previous 3.4% estimate). These projections are slightly lower than the 3.4% growth observed in 2024.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment