The presence of the "Niña" phenomenon is expected to bring rainfall that, if maintained within normal levels, could boost productivity in the main producing countries. However, if the rainfall intensifies more than expected, occasional harvest interruptions in some regions cannot be ruled out.

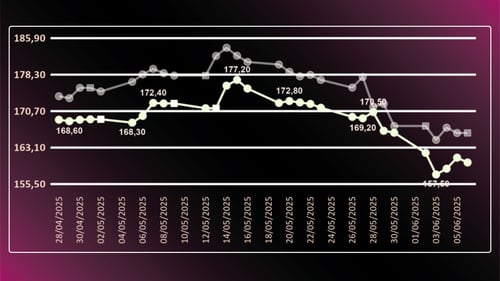

Natural rubber and latex prices | In US$ per 100 kg

Sales grew 3% in the first quarter, driven by light commercial vehicles. This segment is already exceeding pre-pandemic levels, thanks to the rise of e-commerce. This bodes well for the sustained demand for rubber in this channel.

China has restricted the export of rare earths, key minerals for the automotive industry. This could affect production in the US and Europe, and by extension, demand for inputs such as rubber. In China, sales are buoyed by heavy discounts led by BYD, suggesting a possible excess inventory.

Rates on the China-US route have risen by up to 88%. However, this spike is expected to moderate by the end of June. Logistics capacity is beginning to normalize, which is key to predicting shipping costs.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment