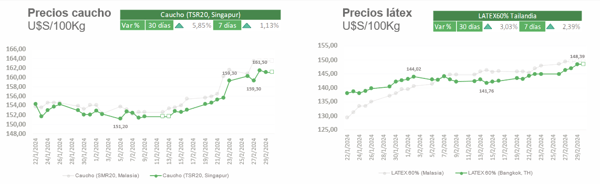

Prices for rubber and latex products remain high due to the expectation of an extension in the leaf change stage of rubber trees. This situation could extend the low production season, increasing the probability of product shortages in the coming months and generating possible price increases. Furthermore, demand indicators, both in China and in the rest of the world, show unclear signals.

Wintering period

The “wintering period” is approaching, the time of year the rubber trees change their leaves and production is significantly reduced. This year, there are indications that this process could begin earlier than usual, prolonging its duration. This situation adds to the poor results that have been observed in recent months, especially in Thailand, where exports have decreased by 24% compared to January of last year.

Impact of external factors on the Chinese economy and variety in demand indicators

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(11).png) Regarding global demand, there is mixed news, especially in China. While the official indicator shows a drop in the industry in February, the private measurement of the Caixin group, which focuses more on SMEs, shows growth. In addition, the request for liquidation of the real estate developer Country Garden and the rebound in the stock market after the announcement of interest rate cuts stand out.

Regarding global demand, there is mixed news, especially in China. While the official indicator shows a drop in the industry in February, the private measurement of the Caixin group, which focuses more on SMEs, shows growth. In addition, the request for liquidation of the real estate developer Country Garden and the rebound in the stock market after the announcement of interest rate cuts stand out.

Contradictory news in the international context .png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(12).png)

On the international scene, the growth of the United States economy stands out, with an industrial sector that expanded more than expected in February. In addition, the latest revision of the 2023 GDP leaves a more robust basis for growth in 2024, given that the consumption and investment data was adjusted upward, and the inventory accumulation data was reduced. On the other hand, the European Union experienced a contraction in its industry, although car sales showed notable growth in January. In Japan, industrial activity fell again, reflecting a less favorable situation compared to other regions.

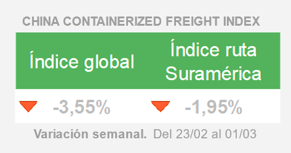

Perspectives on Rates and Maritime Routes in March

- Lingering Effects of the Red Sea Conflict on Global Rates:

DHL anticipates that global rates will remain elevated in March, as efforts by the EU and the United States to resolve the conflict in the Red Sea have been ineffective. Despite this, demand on the Asia-South America route is expected to remain relatively balanced.

- CMA-CMG Restarts Red Sea Routes with Case-by-Case Evaluation: The French company CMA-CMG has decided to resume operations on the Red Sea route, although it will do so under a detailed case-by-case evaluation to guarantee the safety and efficiency of its services.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment