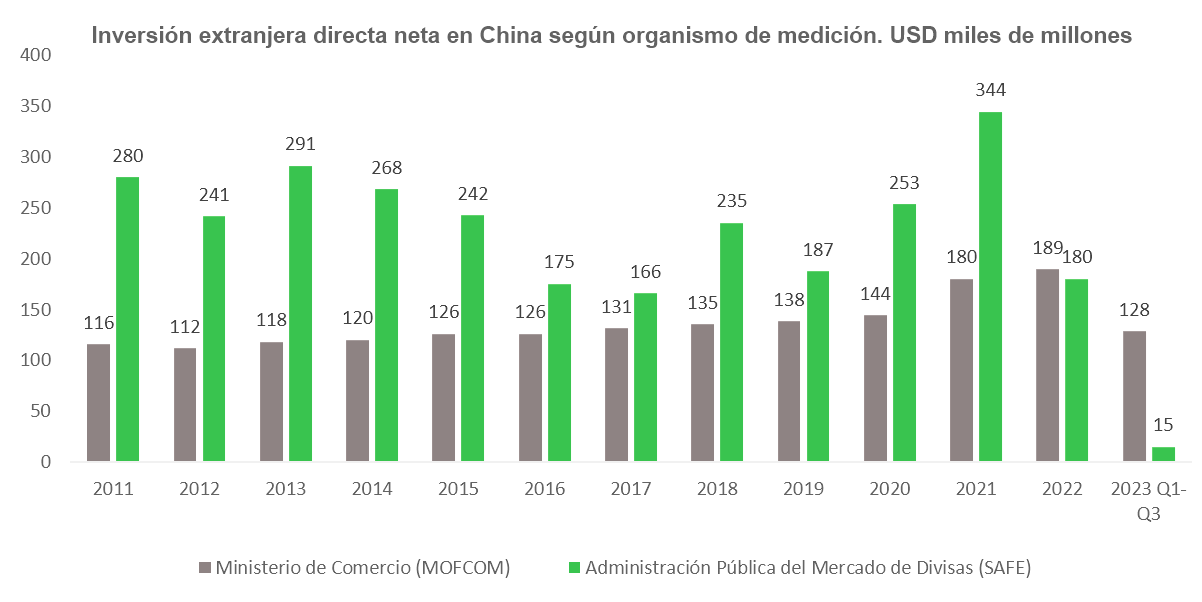

Currently, the Chinese economy faces a significant challenge due to the sharp decline in Foreign Direct Investment (FDI), reaching historical lows. Most of the news that accounts for the collapse in net FDI echoes the measurement of the Public Administration of the Foreign Exchange Market of China (SAFE), which marks a drop of around 90% in the accumulated year, reaching the same almost to zero. The measurement is in net terms, that is, it subtracts capital outflows from China, such as the payment of dividends. Although there are alternative measurements, such as those of the Ministry of Commerce, that present a less alarming situation, the updated SAFE methodology suggests a more precise reality. The differences between these measurements are detailed in a footnote. This decline in FDI raises questions about China's economic future and its global implications. It is important to understand the reasons behind this trend and how it could affect both the country and the global economic outlook.

What is Behind the Fall of Foreign Investment in China?

The decrease in Foreign Direct Investment (FDI) in China has generated concern and has been interpreted as a symptom of structural and cyclical changes in the Asian country's economy. However, closer analysis reveals that although a problem exists, its magnitude may be smaller than perceived. The reasons behind this decline are diverse and are explored below.

One of the main reasons is the relocation of industries outside of China and the preference of some companies to establish factories in other destinations. At a global level, there is a trend of repatriation of certain industrial sectors by central countries. However, companies continue to prioritize cost reduction and operating in stable environments, which motivates this relocation.

Regarding the first reason, many labor-intensive industries are seeking to locate in other Southeast Asian countries that have lower labor costs. This responds to a relatively natural process of economic development: as countries progress and salaries increase, the employment-intensive industries that served their initial development have to give way to sectors more related to technology or human capital, while segments such as textiles and footwear are beginning to seek to locate in countries with less relative development.

Regarding the second point, the close experience of the sanctions that Russia received is leading some multinational firms to reconsider investments in China. There is some fear that production operations or the possibilities of placing their products in other countries will be affected for political reasons, such as the trade war that China maintains with the United States, or its closeness with the governments of Russia and Iran. Or even due to unforeseen decisions by Xi Jiping, how the COVID health restrictions have been extended until 2022, long after the rest of the world had returned to normal. The perception that there is some risk of a war due to the claims that China maintains over the territory of Taiwan does not help either.

Additionally, situational factors impact. One of the most relevant is the increase in the cost of international credit due to the rise in interest rates. This makes many firms decide not to finance themselves abroad to invest in China.

Is the Decrease in Foreign Investment in China Worrying?

In general, a positive flow of foreign investment is usually beneficial for a country, since it helps develop its productive capacity. However, foreign investment requirements can be very different in each case, and a variation in it can be explained by a logical transformation of the economy.

The decline in Foreign Direct Investment (FDI) may raise concerns, but it is important to analyze its impact on the Chinese economic context. Previously, China relied heavily on FDI to accelerate its industrial development focused on exports, the country had many untapped resources and little capital so foreign investments were very profitable and helped development by increasing the productivity of the workforce. . However, over time, the country has accumulated its own capital, reducing its need for external financing.

Another point that is usually highlighted is the impact that foreign investment generates in the development of capabilities through the transfer of technology carried out by multinationals, which is commonly known as “learning by doing.” The income of companies such as Apple or Tesla has generated a great development of knowledge that later helped the emergence of national companies such as Huawei or BYD. However, the reality is that the fall in Chinese FDI is concentrated in labor-intensive sectors. Although this phenomenon may be worrying in terms of capacity development, China continues to attract investments in key areas such as electric vehicles, renewable energy and semiconductors, aligning with its national strategy of being a leader in high value-added products. A decline in these segments in particular would be worrying in terms of technology transfer, and would go against the national strategy of being a global supplier of mass consumption products with high added value.

Reflection on Foreign Investment in China

In short, the decline in foreign investment in China is worrying, but not necessarily alarming. Although it reflects a shift in the drivers of Chinese economic growth, key sectors continue to attract investment. However, it is crucial to be alert to two aspects.

First, this change could mean slower economic growth in the future. Second, it is essential to monitor how the composition of the investment decline evolves, especially if technology companies reduce their outlays due to political concerns. This could compromise the Chinese government's development strategy.

Source: Ministry of Commerce MOFCOM and Public Administration of the Foreign Exchange Market (SAFE)

DIFFERENCES BETWEEN METHODOLOGIES: i)SAFE includes as FDI the initial issuance of public shares of previously private companies in offshore markets; ii) SAFE includes capital movement when foreign participation in Chinese companies reaches 10%. MOFCOM ignores these movements; iii) SAFE has more up-to-date movements of reinvestment of profits or payment of dividends abroad, MOFCOM estimates them with data from last year, which is why it tends to overestimate FDI in times of decline in reinvestment and underestimate it in times of increase; iv) SAFE includes movements in the financial sector, MOFCOM does not; v) SAFE includes loans from foreign banks to foreign companies to invest in their Chinese branches, MOFCOM does not.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment