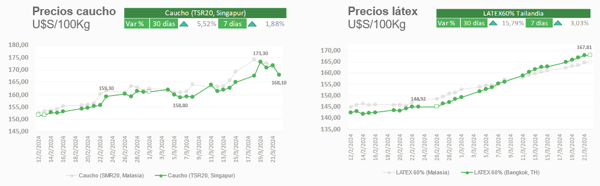

The rally continues, and latex and natural rubber prices reach levels not seen since early 2022.

To the shortage generated by the poor harvest in Thailand, there is now the news of greater than expected growth in the Chinese industry.

It is difficult to say whether or not we have reached a ceiling. There may be opportunity sales in the short term, but we expect prices to remain elevated throughout April. Only from the second half of the year could they weaken, if the end of the impact of El Niño is confirmed.

China economic data: Industrial growth exceeds expectations

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(11).png) China's official economic data for the first two months (the joint two months are analyzed due to the effect of the New Year dates), were surprisingly positive. The growth of the industry stood out, which was 7% year-on-year vs. the expected 5%.

China's official economic data for the first two months (the joint two months are analyzed due to the effect of the New Year dates), were surprisingly positive. The growth of the industry stood out, which was 7% year-on-year vs. the expected 5%.

Retail sales grew 5.5% and gross investment 4.2%. Only real estate investment remains negative, which fell 9%.

In general terms, the new data generate expectations of greater demand for rubber, especially due to industrial expansion, which would become a priority for the government. However, despite this, the majority of analysts continue to believe that it will be difficult to meet the 5% growth goal.

Rubber and latex shortage: Upward pressure on prices persists

.png?width=177&height=177&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(17).png)

The shortage of rubber and latex continues to generate upward pressure on prices. The problems reached such a point that speculation is beginning that the Thai government itself will allow the import of rubber in its primary forms to counteract the shortage of supply.

.png?width=180&height=180&name=Dise%C3%B1o%20sin%20t%C3%ADtulo%20(15).png) Delay in EU regulations: Impact on rubber trade

Delay in EU regulations: Impact on rubber trade

The European Union delays the application of anti-deforestation regulations, which will imply the entry of rubber products that cannot prove that they have not generated deforestation in recent years.

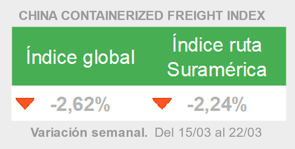

Tensions and challenges in global shipping

- Although some declines are expected in the coming weeks, freight rates will remain high given that the main disruptions to international transit are far from being resolved.

- The Panama Canal continues to see minimal water levels, and daily traffic has been reduced from 36 to 24 ships.

The Houthis expand their attacks on ships linked to Israel that circulate in the Indian Ocean

CH Robinson warns that the Ports of Sao Paulo and southern Brazil are operating below their capacity and with delays.

.png?width=3000&height=1023&name=Logo%20Alrubber%20Color-01%20(4).png)

Submit a comment